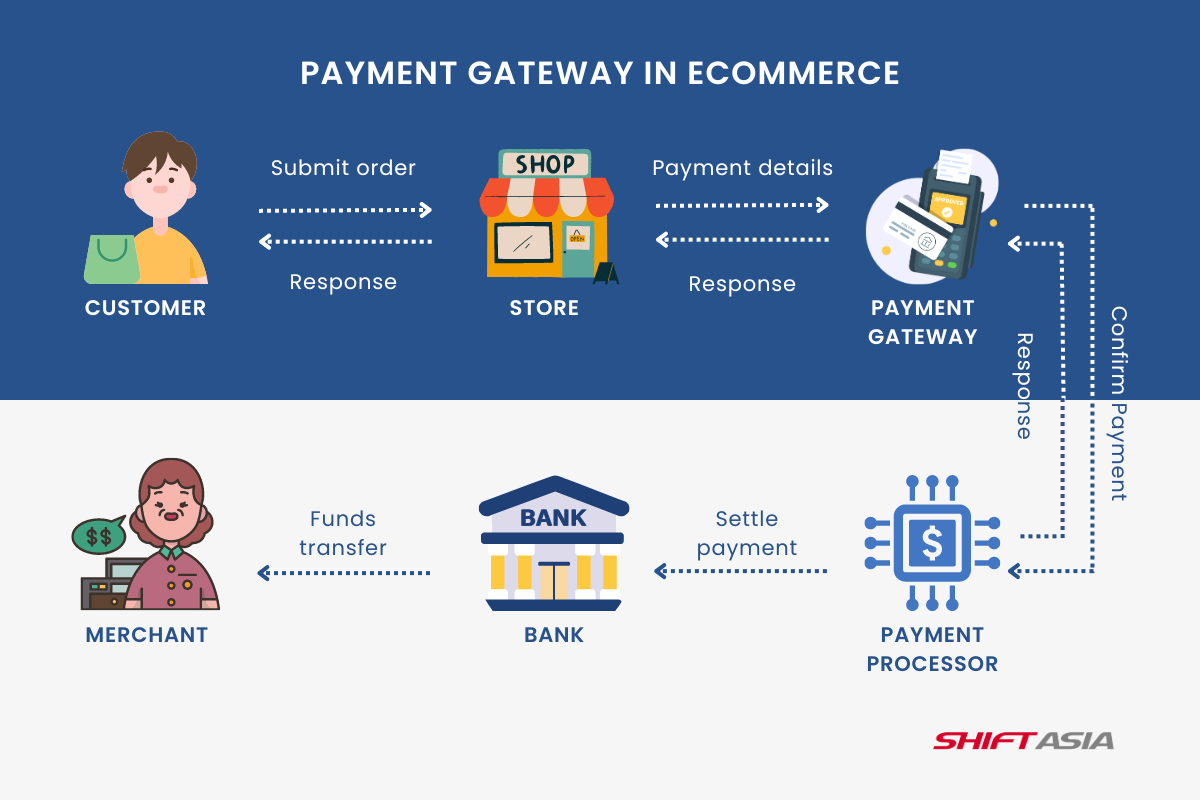

In eCommerce, a Payment gateway serves as a trusted intermediary, facilitating secure fund transfers from the customer’s bank account to the merchant’s. Regardless of the payment mode, whether it’s net banking, UPI, or online wallets, the payment gateway carries out critical criteria in order to deliver smooth completion of your online transactions.

Trust me when I say you want to avoid having any trouble with the payment gateway. Not only does it affect your business reputation and customer experience, but solving the issue for the customers would be a pain. If you aim to bring the seamless payment experience there is to your customers, thorough testing of the payment gateway is pretty much like the cherry on top, the “almost” final stage of any conversion mechanism a business would want their customers to pass through without encountering any interruptions, even the smallest one. Anything from here can either go sideways or a successful revenue conversion. Need help devising test cases for your payment gateway? We have generated a comprehensive payment gateway testing checklist for you to cross off while you’re on it and ensure yours are on the right track. Without further ado, let’s jump right into it, shall we?

What exactly is a payment gateway?

For an e-commerce website or application, a payment gateway is the essential middleman that securely handles the financial transactions between your customers and your business. It securely accepts credit/debit card/e-Wallet details to complete purchases. It encrypts sensitive information such as card numbers, account holder names, CVV numbers, and passwords to secure transactions, thus enhancing the online shopping experience and minimizing the risk of fraud. In short, a payment gateway for an e-commerce platform ensures a secure, smooth, and efficient payment process for both customers and businesses. It fosters customer trust and convenience while protecting the e-commerce business from financial risks.

Different Types of Payment Gateways

Hosted Payment Gateway (Self)

A Hosted Payment Gateway, such as PayPal Standard, Payza, or 2Checkout, automatically redirects customers away from the eCommerce website’s checkout page. Once customers click the payment button, they are immediately directed to the desired payment service organization’s authorized page, where they can safely input their details. Once the payment is completed, customers are redirected to the site page. This type of payment gateway does not require a dealer ID.

Self-Hosted Payment Gateways

Self-hosted payment gateways allow merchants to collect payment details directly on their own websites, requiring them to manage the security of this sensitive information. This type typically demands a higher level of technical expertise and adherence to compliance regulations, as the business is responsible for safeguarding the payment data.

API-Hosted Payment Gateways

API-hosted payment gateways provide a flexible solution for businesses by allowing them to integrate payment processing directly into their applications or websites. This method combines elements of both hosted and self-hosted solutions, enabling businesses to maintain more control over the user experience while still leveraging the security capabilities of the payment processor.

Payment Gateway Testing

Testing the Payment Gateway involves verifying its functionality and reliability within an online purchasing system. The primary goal is to safeguard the payment process’s security, dependability, and efficiency, encrypting and securing payment details between users and merchants to facilitate a seamless transaction experience.

A payment gateway is an essential component of eCommerce. It facilitates credit card payments for online purchases while safeguarding sensitive information such as credit card numbers and account details through encryption. This helps deliver safe data transmission between customers and merchants. Additionally, modern payment gateways securely process payments using various methods, including debit cards, electronic bank transfers, cash cards, and reward points.

Types of Testing for Payment Gateway

Different types of testing aim to obtain maximal reliability and optimal functionality of the payment gateways:

Functional Testing: Determine whether or not the payment gateway functions as intended, particularly for newer or less established gateways. It verifies that all gateway components are working correctly, ensuring proper interaction between the application page and the gateway. However, more established payment processors may not require this type of testing, as they handle orders, calculations, and charges accurately.

Integration Testing: Testers need to certify that the online store integrates seamlessly with the specified payment gateways. Testing the entire transaction flow, including verifying placed requests, confirming receipt of transaction amounts, and checking for refunds or void transactions.

Performance Testing: The website’s performance must be tested to understand why the payment process would not fail if multiple clients attempted transactions simultaneously. Increasing the number of clients beyond a certain threshold level during testing helps evaluate the payment gateway’s performance under load.

Security Testing: Security testing is imperative to protect sensitive data transmitted through the payment gateway. During transactions, clients provide sensitive information such as credit card numbers and CVV numbers; this helps keep all data encrypted and ensures that the gateway is secured.

Additional types of testing are, but not limited to:

Cross-Browser Testing: Checkout page across multiple browsers to identify any UI or functionality issues specific to individual browsers, operating systems, or devices.

Regression Testing: If any changes are made to the application, we must conduct regression testing on related modules, including the checkout page, to prevent any defects from arising due to modifications in the cart UI or payment API.

Payment Gateways Test cases

| User Interface (UI) Test Cases |

|

|---|---|

| Functional Test Cases: |

|

| User Information |

|

| Performance Test Cases |

|

| Order Review |

|

| Confirmation and Communication |

|

| Cross-Browser and Device Testing | Test the checkout process on web browsers and devices for a responsive experience. |

| Security Test Cases |

|

Choosing the Right Tool for Payment Gateway Testing

How do you choose the best automation testing tool for your specific needs? Here are some key points to consider:

Understand your project requirements: For checkout testing, opt for a testing tool that supports security, cross-browser compatibility, API testing, and regression testing.

Consider timeline and budget: Choose a tool that fits your testing budget and allows you to execute tests within the designated time frame. You can choose between code-based or codeless testing tools based on your preferences and requirements.

Scalability: As your website evolves, especially the checkout section with added options like gift cards and coupons, ensure the tool you select can adapt to these changes and effectively test them.

Integrations and Support: While checkout testing may be your primary focus, it is beneficial to choose a tool capable of performing various types of testing.

Takeaway

Each eCommerce website has its own set of customers, so depending on your target audience, your take on eCommerce aesthetics designs or functionalities might vary. Although we might all share the same goal of a customer’s complete payment transaction, having that last action executed effortlessly is more effortful. It takes a decent amount of repeated and regular testing to achieve the same results for every single transaction.

To achieve this, craft your test cases mindfully, given the involvement of your customers’ sensitive information as the highest priority, treating them as your own. In this harsh eCommerce digital age, letting down your customers’ trust once and there isn’t anything you ever do that helps to earn it back. Therefore, it’s always worth it to go the extra mile to protect and seal them away from frauds and cyber thieves, which are the ethnic that testers and developers should consider.

ContactContact

Stay in touch with Us